Soaring Land Costs and the Future of the Family Farm

by George Powell

Farm Credit Canada’s annual report on farm values revealed soaring farmland costs across the country in 2021. This is good news if you are intending on liquidating your farm holdings. But bad news if you are trying to get started in agriculture and for society as a whole.

Record High Land Costs

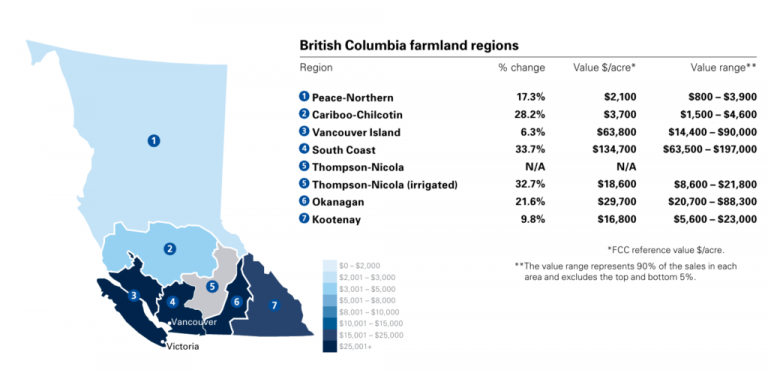

Across Canada farmland prices increased by 8.3 percent in 2021. In British Columbia, it was a whopping 18.1 percent rise. And, in some BC regions the jump was even more acute. For example, farmland values in the South Coast region rose by 33.7 percent, and by 28.2 percent in the Cariboo-Chilcotin.

This trend of ever more costly farmland has been in place for more than a decade. In fact, Canadian farmland prices have posted an average annual increase of 10.8 percent since 2012. This far outpaces inflation. And, it has profound implications for the future of the family farm.

Farm operators (aka farmers and ranchers) are getting older. Their average age was 55 as of the 2016 census of agriculture release. Many are part of the post-world war baby boom generation. And as they look to retirement, for the most part, younger generations are taking a pass on replacing them. This lack of recruitment poses a serious challenge to the long-term viability of agriculture in BC and all of Canada.

But, in order to bring on a new generation of farmers and ranchers there needs to be some hope of making a good living. But that is not the case for many. For example, a recent survey conducted by the Small Scale Meat Producers of BC found 37 percent of their sector operate at a loss. Another 29 percent only break-even. And, almost all (96 percent) of these small-scale family farms rely on off-farm income to supplement their farm gate sales.

This too is not a new phenomenon. Agriculture has always been a low margin, high capital cost endeavor. But generations of family farms still built wealth through capital gains. Farming, supplemented by off-farm income, generates cash flow to keep the creditors at bay. The pay off in farming and ranching has come in the form of long-term asset appreciation. Gains in the value of breeding herds, maturing timber, farm infrastructure and the land itself.

So, you might conclude that soaring farmland values are good for farmers because it means a bigger payoff for years of work. Indeed, this is good news if you are intending on liquidating your farm holdings. But it is bad news if you are trying to get started in agriculture. And thus bad for the sector in light of the difficulties of recruiting new entrants.

The New Land Rush

In the past two decades farmland has become a desired ‘asset class’ among investors. This has been coupled with cheap money stemming from the hyper-inflationary monetary policies of the Bank of Canada. And, as a result, investors bidding up the price of farmland beyond what would be expected based on its intrinsic value to produce food and other goods.

In British Columbia, not all farmland is created equal. Valley bottoms and southern geographies tend to have more productive land because of superior climate and soils. But this intrinsic value has been greatly distorted by proximity to major urban centres. This is true even though the Agricultural Land Reserve provides a measure of protection from conversion of farmland to non-farm uses.

For example, farmland around greater Vancouver now costs an average of $134,700 per acre. Land in northern BC sells for an average of $2,100 per acre. Lower Mainland farms are more productive and can produce a wider range of crops than in the north. But they are not 60 times more productive than northern BC farmland.

Emerging Neofeudalism

Those who are interested in agriculture, but are not fortunate enough to inherit land, now face a monumental hurdle to owning a farm. And a tenant farming system is emerging for new farm operators who increasingly must turn to land leasing and rental options. That is, when they are even available.

The tenant farmers still take on the all the agricultural production and market risks, sometimes with little or no profit. But their landlords capture all of the value creation through land appreciation.

The hollowing out of agriculture and loss of family farms will lead us to new form of feudalism. And this has profound implications for rural economies and social structures.

Agriculture, dominated by family farms, has been the backbone of the Province of BC. It has a stabilizing effect the boom and bust cycles of forestry, mining and recently tourism. Agriculture also reinforces circularity in regional economies. The farmers and ranchers of BC, for the most part, earn and spend their income where they live.

Increasing corporate ownership of the land and loss of family farms can turn this upside down. Corporate ownership takes its profits to Bay Street and beyond. It also doesn’t need nor necessarily support rural jobs. Without local owner operators, large corporate farms increasingly rely on temporary foreign labour. And it doesn’t even care if the farmland it owns is farmed. Many would be just as happy to collect ‘ecological goods and services’ credits from the government or environmental NGOs for not farming.

And this can lead to even greater reliance on food imports, with associated diminshment of our independence, rural social fabric and food security.

Three comments on “Soaring Land Costs…”

Devin 19 March 2022 at 9:21 am

Great post. Well thought out and presented. How do you think climate change will impact farm prices?

George Powell (responding to Devin) 19 March 2022 at 9:47 am

Thanks taking time to read and comment Devin.

The impacts of climate change on BC will vary by region. In some regions it could definitely diminish the productive capacity of farms and that would lower the land’s value for farming. For example, increasing flood frequency in the Fraser Valley is either going to drive up individual costs for insurance and repairs, or it will cost hundreds of millions to put in appropriate regional diking and drainage infrastructure. The closer you get to the delta, a higher risk of salt water incursion onto farmland comes into play from rising sea levels. And large areas of farmland in the southern interior will only be suited to seasonal livestock grazing unless water rights and irrigation are in place. Rain-fed agriculture is becoming a thing of the past.

On the flip side, net-net, farmland in the central interior and northern BC will likely have increased productivity due to an improving climate. The winters are getting shorter and milder. That means a longer growing season and wider range of crops that can be profitably grown with better yields.

However, given that one my main arguements is that farmland prices have decoupled to a large degree from the productivity of the land, perhaps it is all moot. I think macro factors outside of agriculture (e.g. monetary policy) are driving the price appreciation.

Douglas Chen 13 April 2022 at 3:26 pm

The Canadian monetary policy is on its turning point. Seems to me, productivity and access to a sustainable market are more fundamental factors than land costs and funding the young farmers shall consider before committing themselves to a farming life.

Comments are closed.

Subscribe via RSS